Sync Contact Data on Open and Close

When you open or close a tax return, ATX syncs with CCH iFirm, recognizing changes to contact data. The following data is exchanged between ATX and CCH iFirm:

- Taxpayer name/Business name

- Address, city, state, and ZIP Code

- Work, cell and home phone numbers

- Email address

- Date of birth

- Date of death

- Related contacts:

- Spouse

- Dependent

- Beneficiary *

- Partner *

- Shareholder *

*Syncing Partner, Shareholder, and Beneficiary Contact Data: Entity Type must be specified on Schedule K-1 forms for Partners, Shareholders and Beneficiaries to sync properly between ATX and CCH iFirm.

ATX requires an SSN or EIN to sync with CCH iFirm’s contact database. If you create contacts in CCH iFirm, be sure to enter the SSN or EIN before importing into ATX. If you create an ATX return for a CCH iFirm contact that does not have an assigned SSN or EIN, the system assumes that this is a "new contact" and a duplicate contact is created in CCH iFirm.

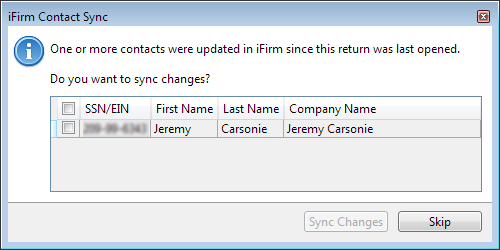

Sync on Open

When opening a return, if there are changes from CCH iFirm, ATX recognizes these changes and asks if you would like to sync them.

To sync updated contact information from CCH iFirm when opening a return:

- Open your return. For more information, see Opening Returns. When changes have been made to the contact in CCH iFirm, a dialog appears asking if you want to sync:

CCH iFirm Contact Sync dialog box

- Select the check box for the contact(s) you want to sync.

- Click Sync Changes.

If you want to keep the current information in ATX, click Skip.

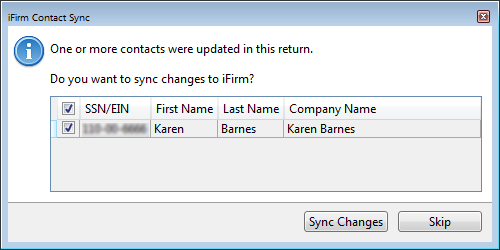

Sync on Close

When you close a return, if there are supported field changes, ATX asks you if you want to sync the changes to CCH iFirm.

To sync updated contact information from ATX to CCH iFirm when closing a return:

- If changes have been made to the contact in ATX, a dialog appears asking if you want to sync:

CCH iFirm Contact Sync dialog box

- Select the check box for the contact(s) you want to sync.

- Click Sync Changes.

If you want to keep the current information in CCH iFirm, click Skip.

See Also: